I remember exactly what I was doing when it happened. I was on my bed, in my dorm room, watching my 19 inch TV which was tuned to CNBC.

My favorite show at the time was Squawk Box and everyday I watched it for stock tips.

The day before I had just saw them mention a new stock that was on the rise. Naturally, I logged into my trading account and bought a few shares.

But today something was wrong.

The stock was down.

I thought they said this stock was moving up?

That was one of the many mistakes that I made when I first started investing.

If you’re new to investing or you want to get started, you might be scared to make mistakes and lose money.

Nobody actually wants to lose money, am I right?

If you want to start investing but you want to avoid rookie mistakes, then pay attention closely. Here are 7 top investing mistakes that every beginner makes.

Choosing the Wrong Investment Vehicle

I first started investing inside of a Roth IRA. That is a retirement account where you add money after it is taxed. I figured that would be the easiest way to save for retirement and invest at the same time.

While I had the right idea, the vehicle I chose wasn’t exactly the best one. I was picking individual stocks inside of my retirement account. Knowing what I know now, I would have chosen to invest in index funds instead.

An index fund is a type of fund that just follows the broad market. So if the market goes up, it goes up. And if the market goes down, it goes down. The index is such a large selection of individual stocks that you don’t have to worry about any one stock in particular ruining your retirement plans.

Now I invest in ETFs and mutual funds inside of my retirement account. Mutual funds usually require a higher dollar amount so if you are starting with just a few hundred dollars then you will want to look into ETFs (Exchange Traded Funds) until you have enough to switch over to mutual funds.

Watching the Markets Too Much

As soon as I put my money in the markets, I started watching the ups and downs every day. Every little piece of news made me question my decision. I had no idea that the market moves in natural flows like the ocean.

Typically, if the market hits a new high, the very next day it will be down. The market also moves the same during earnings season as well, if you know what to look for. But then again, there are times when you might think that good news would make the markets go up, only to see that it’s dropped.

Watching the markets everyday helps you to get used to the movements, but if you try to make decisions based on what it does every day, you’ll only ruin your investment account’s growth.

Not Re-investing Dividends

My entire goal when investing was to earn extra money. I figured if I could buy enough dividend paying stocks that I could live off of the quarterly checks. Once again I had the right idea, but the way I went after that idea was not exactly the best way to do it.

I bought individual stocks and decided not to reinvest the dividends. But because I didn’t have tens of thousands invested, my dividend checks weren’t even enough to withdraw. I would have been better off reinvesting those dividends so I could allow my investing account to grow.

I finally decided to start a blog to earn extra money and that started to pay me anywhere from $100 to $200 a month; way more than I could have made from my investing account.

Don’t invest to make extra money. Invest the extra money that you make from a side hustle.

Now I reinvest all of my dividends.

Choosing Stocks Based on TV

As I mentioned at the start of this post, I used to watch Squawk Box on CNBC and invest in whatever stocks they mentioned. Then sometimes I would watch a commercial and think, “that must be a good company.” and I would buy some of their shares.

I had no idea why my stocks weren’t going up in value until I actually learned how to research a stock. And I was so ready to jump into the market I didn’t want my cash just sitting around. I wanted it to start earning for me.

But picking a stock just because you want to invest is definitely not the best way to make a good investing decision.

These days, I set aside an investing fund. I put the cash into an account with ETFs until I find a good individual stock that I want to invest in.

Withdrawing Investment Gain Early

This is another mistake that I see a lot of beginner investors make. When choosing a good stock, you want to pay attention to the 3 and 5 year projections. If you are not prepared to invest for 3 or 5 years then you are really just trading. (There’s nothing wrong with trading but there are different risks and considerations.)

The mistakes and drops smooth out over time and that is how long term investors win. Because they stay in the market and ignore all of the noise.

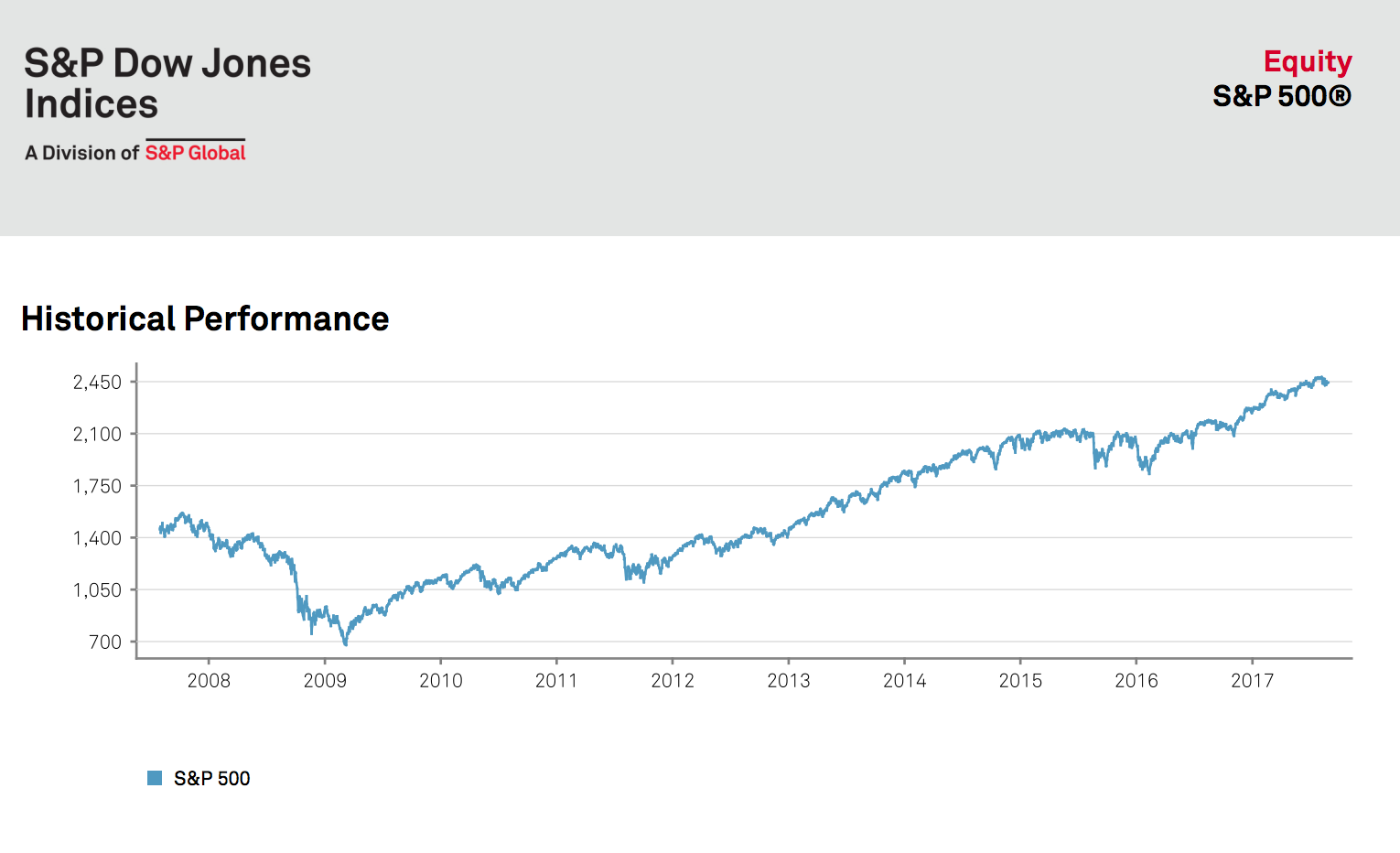

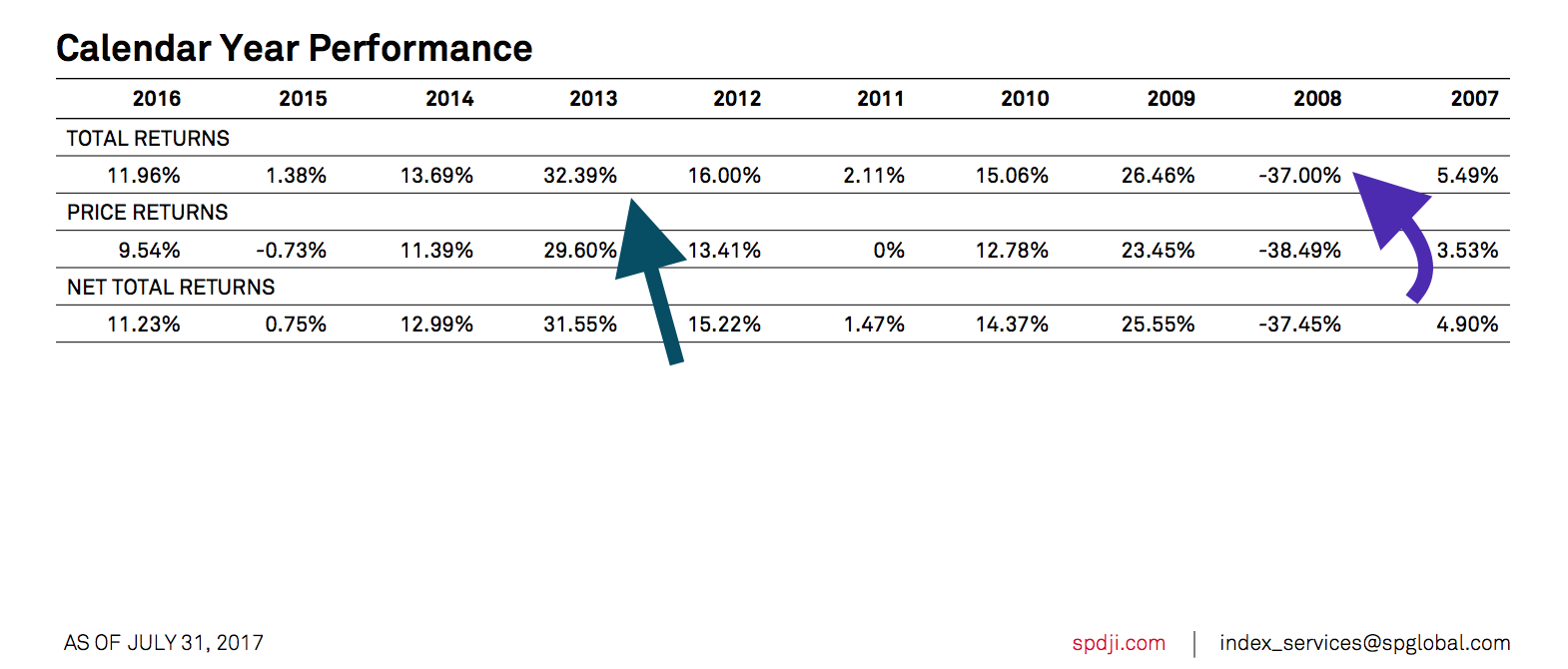

Check out this chart from the last few years which includes the dip from the Great Recession.

If you had started investing beforehand and left your money in the markets, you would have had all of your money back by mid-2013 and close to doubled by 2017.

(Source: SpIndices.com)

However, if you were trading and removed your money at the bottom, you would have missed the upswing that came directly after in 2009.

And if you were too scared to invest again you would have missed the positive returns that came every year after that downturn.

The point is, if you’re going to start investing, get comfortable with the long term.

Forgetting to Diversify

“Don’t put all of your eggs in one basket.”

That is the idea of diversification. When you diversify, you spread out your potential loss over many options. You also spread out your potential gains.

(Remember, if you really want to earn extra money, you should be looking into a side hustle. You’ll make way more than you would from investing today. Investing is the long game. A side hustle is the short game.)

I’ll make this quick and easy. One of the easiest ways to diversify is buying more than one exchange traded fund. You want your portfolio to benefit from local growth, small businesses, large businesses, growth from new explorations, overseas opportunities, etc. The most cost efficient way to do that is by buying a diversified ETF portfolio. That’s where a managed investing account like the one offered by Ally Invest comes into play.

Ally Invest will even allow you to create your own diversified ETF portfolio for only $4.95 per ETF. Check them out here. (*partner link)

Investing Too Little

When I wanted to start investing I didn’t have that much to start with. Some people have parents to start them off with an investing account, or a job that pays well enough so they can get started. I didn’t have that. What I did have was a good bit of credit card debt. And even though there are financial gurus who will say don’t invest until you’ve paid off your debt, I say that you can do both.

I budgeted out a percentage to go towards debt and a little bit to go towards investing. It’s all about creating habits no matter where you are in your financial journey.

But even with setting a percentage, I still only had a little bit to start investing.

When you get started you want to put at least $500 into an account.

Take some time to save this up if you have to because it will be a good base for you to start from.

If you really want to start investing but you’re not sure where to even start, then you should take this quiz that I created.

The quiz will tell you what your investing personality is and you can also choose to get a free 5 day email course to help you get started with investing.

In 5 days I’ll show you how to find your first stock so you can start investing.

I’ll even send you my free investing guide for quick reference.