The FICO® Credit Score is a credit rating that forms a major part of the information used by lenders in assessing the risks involved in a loan application. This score is used to decide whether to extend a loan or grant credit. FICO® is an acronym for the company that created it, the Fair Isaac Corporation.

The Key Factors to Your FICO® Score

The FICO® Score is computed using various key factors from information available in your credit reports. The components are divided into 5 groups, and each account for a percentage of your overall score:

- Payment History – 35%.

- Debts or Amounts Owed –30%.

- The Age of your Credit History –15%.

- New credits or inquiries –10%.

- Types of credit/combination of accounts –10%.

The exact percentages and weights are proprietary to the scoring model; refer to these as approximate weights only.

How Lenders Use Your FICO® Score

The FICO® Score scoring system converts your entire credit history into a three-digit number: lenders use this number to determine your “creditworthiness.” This three-digit number influences the conditions and amounts – if any – that will be offered to you in a credit application. It is used to predict your future behavior; how you will pay, if you will pay, etc.

For lenders, this kind of information is very important. It helps them evaluate how likely a person is to pay his/her bills on time, forecast the accounts which are likely to default, and identify the profitable accounts, among others. In addition, insurance companies often use credit scoring in their business processes to help them to determine which customers are likely to file claims.

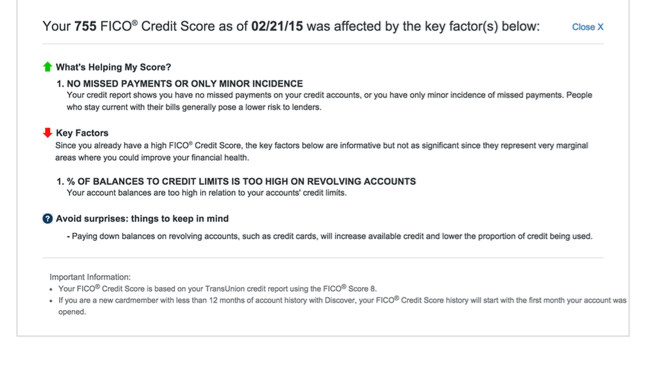

In general, payment history and existing loans influence your FICO® Score the most. People who have paid their loans past the due date and are using all of the credit available to them often receive poor credit scores. On the other hand, a missed payment once 5 years ago is unlikely to affect your score greatly. Minor issues, particularly if they happened a few years back, cannot ruin your score.

Where to Get a Free FICO® Score

The credit bureaus that collect and process credit scores; Experian, TransUnion, and Equifax, are not required by the law to provide scores to individuals. For this reason, you might conclude that the only way to get your FICO® Score is to pay for it. Fortunately, there are ways to get your FICO® Score or an approximation of it absolutely free.

You can get your approximate FICO® Score by registering for a free service like Credit Sesame or Credit Karma. The score that you see is typically based on the same key factors but it is not a FICO® Score, only an approximation.

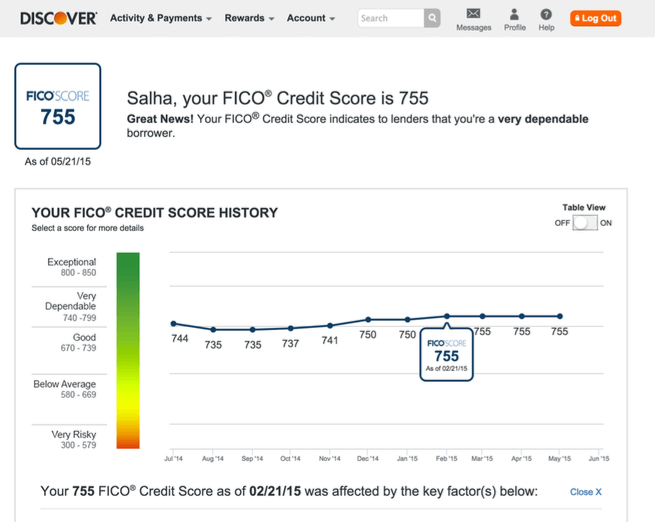

Certain credit card issuers offer a FICO® Score for free to customers. For example, as a Discover cardmember you can view up to a year’s history of your FICO® Credit Scores and receive key factors from your credit history impacting the scores – available online and on statements. Discover was the first major credit card issuer to proactively provide free FICO® Scores on cardmembers’ monthly statements. And now with the FICO® Credit Score tracking, you can understand the why behind your personal FICO® Score.

Have you checked your credit score recently?

This post was created as a part of the Discover partnership program.